Top 10 European Venture Capital Deals of February 2025: Investment Funding Trends Every VC Should Know

The Top 10 Venture Capital Deals That Dominated February

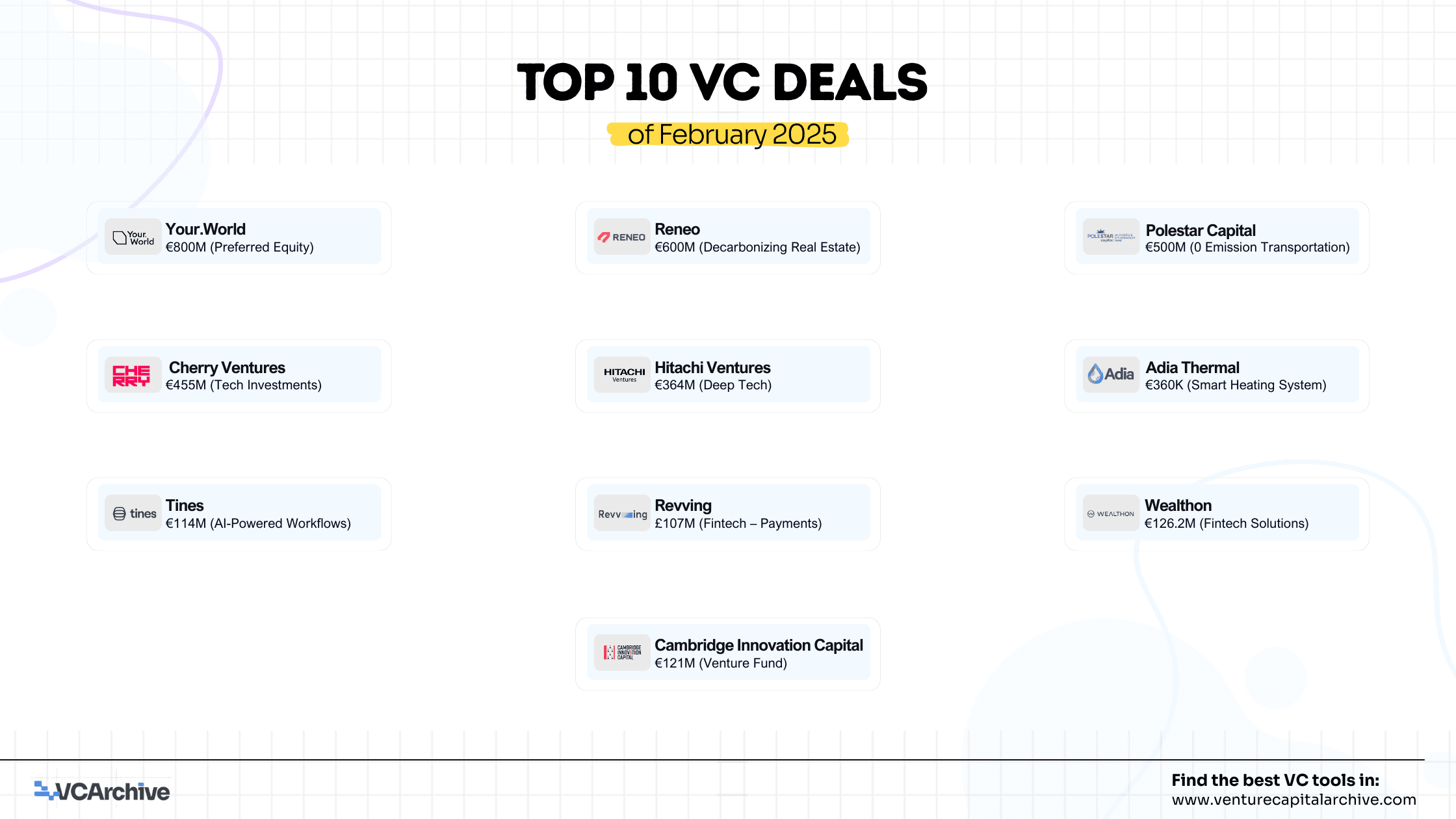

February's investment funding activity was anchored by these standout deals:

- Your.World: €800 million in preferred equity from Ares Management Credit funds and Carlyle

- Reneo (Hamburg): €600 million capital platform for decarbonizing residential real estate

- Polestar Capital (Netherlands): €500 million fund launch targeting zero-emission transportation

- Cherry Ventures (Berlin): €455 million ($500M) fifth fund for European tech

- Hitachi Ventures (Munich): €364 million ($400M) fourth fund for deep tech innovation

- Adia Thermal (London): €360K for smart home heating systems enabling heat pump adoption

- Tines (Dublin): €114M ($125M) Series C for AI-powered workflows, reaching unicorn status

- Revving (UK): £107M for its fintech platform solving delayed payments

- Wealthon: €126.2M for its fintech solution

- Cambridge Innovation Capital: €121M for its venture capital fund

The concentration of venture capital in these mega-rounds signals growing institutional confidence in European tech, with sustainability and enterprise software capturing the largest share of investment funding.

Sector Analysis: Funding Magnet for VC

Breaking down February's investment funding by sector reveals several compelling narratives for VCs

1. Climate Tech: The New Venture Capital Darling

The surge in climate-focused venture capital signals a market approaching maturity. Notable deals included:

- Polestar Capital's €500M fund: Dedicated entirely to zero-emission transportation

- Connected Kerb: €78.4M for EV infrastructure expansion

- Nido and ReCarber: €5.1M each for innovative climate solutions

- Scale Energy: €2M for renewable energy innovations

Early-stage climate tech is transforming from "impact investing" to mainstream venture capital opportunity, with solutions addressing regulatory-driven markets showing particularly strong commercial potential.

2. AI Venture Capital: Beyond the Hype Cycle

While AI dominated 2024 venture capital headlines, February's investment funding shows a maturation toward practical enterprise applications:

- Tines (Dublin): €114M ($125M) for AI-powered workflows

- Nomagic: €41.5M for industrial AI applications

- Salience Labs: €28.6M for specialized AI hardware

- Multiple sub-€10M venture capital rounds in legal, supply chain, and healthcare AI

The venture capital market is increasingly differentiating between AI companies with clear ROI and those still searching for product-market fit. Specialized vertical applications with demonstrable value are outperforming general-purpose platforms in securing investment funding.

3. Biotech's Renaissance in European Venture Capital

While not capturing the largest rounds, biotech showed remarkable depth in venture capital activity:

- GreenLight: €35M

- EG 427: €27M

- Enduro Genetics: €12M

- Spore.Bio: €27.44M for deep tech applications

- Multiple sub-€10M rounds for novel therapeutic approaches

European biotech is building momentum with more capital-efficient models than traditional pharma R&D, creating opportunities for specialized venture capital investors who understand the regulatory landscape.

Geographic Distribution: Europe's Expanding Venture Capital Map

London, Berlin, and Paris continued their dominance in venture capital, but February saw significant investment funding activity in emerging ecosystems:

- Netherlands: Becoming a powerhouse for sustainability and energy transition funding

- Spain: Madrid-based IDC Ventures launched a €150M fund of funds

- Ireland: Dublin's Tines reached unicorn status with its latest venture capital round

- Central & Eastern Europe: Several deals in the €1-5M range across deeptech and enterprise software

Portfolio diversification across multiple European hubs provides venture capital firms access to specialized talent pools and often more favorable valuations compared to the established centers.

Early-Stage Venture Capital: Seed Funding Landscape

While mega-rounds dominated the headlines, seed stage venture capital activity remained healthy:

- Average seed round: €2.8M across sectors

- Most active sectors for venture capital: Applied AI solutions, climate tech, and specialized SaaS

- Notable trend: Increased corporate participation in seed rounds, particularly in deeptech

The current investment funding environment favors disciplined founders with clear paths to revenue and capital efficiency, creating opportunities for early-stage venture capital investors who can identify capital-efficient models with rapid time-to-value.

Strategic Considerations for Venture Capital in Q2 2025

As we move into Q2, several factors merit close attention from venture capital firms:

- Sector convergence: The lines between climate tech, AI, and traditional industries continue to blur, creating investment funding opportunities at these intersections

- Fund formation activity: The launch of several new venture capital funds suggests continued LP confidence

- Exit environment: The health of the exit market will be crucial for unlocking returns from the 2021-2023 vintage investments

- Valuation adjustments: Some sectors are seeing pricing corrections, creating potential entry points for strategic venture capital investors

Takeaway

February's venture capital data reveals a European ecosystem that has matured considerably, with greater specialization and deepening expertise across sectors. For venture capital firms, the opportunity lies in identifying companies that can efficiently deploy investment funding to capture large markets while navigating an increasingly competitive landscape.